Are there any perfect settings for your Grid or DCA bot? Which risk-management tools should you use? There are so many ways to set up a bot – read what traders from our community say about it!

In order to gain these insights, we’ve talked to the traders of our community who kindly agreed to share.

I adjust crypto bots’ parameters constantly

NasterAC

The one perfect configuration doesn’t exist. With each crypto trading strategy, many things must be taken into account, specific to each portfolio (amount, objective, time). The market is so volatile and a subject to manipulation and/or speculation. In my experience, you must adjust your parameters constantly because the market moves, and if you stay static, you’ll lose or, in the best case, won’t progress.

“But if there’s something I’ve learnt over this short period of time is that patience, discipline and consistency are the keys… Define your crypto trading strategy … manage risks and be attentive to the market.“

My advice is research the market, set objectives, and do not invest what you are not willing to lose. This is an asymmetric but two-way market: with little, you can earn a lot, but with a lot, you can earn a little, too, and even lose everything.

I’m not taking risks with coins I don’t know

KMikko

My advice to all the newbies out there would be to use only coins/tokens you don’t mind holding for a long period of time in case things go sideways. Also, set up multiple extra orders (5-25) so that bots don’t get stuck in big pumps or dumps. Are you going long? Attack low take-profit targets. Time to go short? Set up higher take-profit targets.

“I bet there are more profitable settings but with these ones, I can go on a 2-week vacation without my laptop, and I’m not too worried about what happens meanwhile.”

So, always have both longs and shorts opened for best pairs. Don’t use a stop-loss order – I personally prefer to wait because I believe the price will come back. Also, go for multiple pairs with the same coins, such as XTZ/USDT, XTZ/BTC, XTZ/ETH.

To sum up, this all is quite a safe bet, I’m not taking risks with coins I don’t know or believe in, and most of my money is sitting in extra orders if the market is not volatile.

I don’t buy big bags on green candles

ivanverr

I agree with KMikko about using only those coins/tokens you don’t mind holding for a long period of time in case things go sideways. In addition to that, I’d also recommend you to get to know the coins and projects behind them, which will lead to building a solid hedged portfolio. Some coins have a 10X potential, it’d be a shame missing out on those.

Set up multiple extra orders (5-25) for bots not to get stuck in big pumps and dumps – mind the step of extra order, which is a key. This will help you to not blow off half of your account’s money in one cycle.

As for low take-profit targets for going long, it depends! If you know what you’re doing, you can have higher TPs, especially for the coins with low liquidity. For example, I had 3% TP on DREP/BTC, TROY/BTC and FET/BTC. Those trades alone made me $100 a day.

In the context of higher take-profit targets for shorts, you can also set up a martingale as a yield enhancer, but with 3-4 extra orders max.

“The best strategy in crypto is simply a combination of risk-management tools and knowing what you are doing. Never FOMO, don’t buy big bags on green candles, do interscalps in between your average entry and exits, and overall be very, very patient ;)”

Do I always have both longs and shorts open for best pairs? I’d say, that’s been proven to be mostly a break-even kind of strategy rather than a win-win situation. If you short, you’ll lose on long, and vice versa.

I am not sure that XTZ/USDT, XTZ/BTC, XTZ/ETH is the best setup. It can be very risky, look at ETH now for example: it pumped 20% over a couple of days. If you had all the above positions taken, you’d bleed XTZ and possibly never be able to make it back.

I check charts daily

rry00

I follow a similar crypto trading strategy as @ivanverr, but with only 3 pairs.

“I check charts daily with few indicators in order to place or keep a long or short with a very simple analysis.”

Sometimes I cancel my deal when I believe that the take-profit price is difficult to reach. It happens, for example, when the trend changes, so I immediately set up an opposite trading bot – say, if it was a short bot then, I set up the long one).

I consider TradeSanta as a partner to trade in a semi-automatic mode. ??

I set up more crypto trading bots

komutanlogar_btc

I’ve been using TradeSanta for about 9 months now. In the early days, I was not earning much. Things changed when, by trial and error, I figured out the strategy that worked best for me.

“I believe there’s no correct universal settings. Traders should look at the market movements where each coin has its own unique volatility and character.”

My philosophy is that a greater number of bots means more opportunities. Instead of locking big sums of money in a bot, I set up more bots and then make adjustments according to their performance. If the bot fails to deliver results, I either delete the bot or decrease the bot’s trading volume.

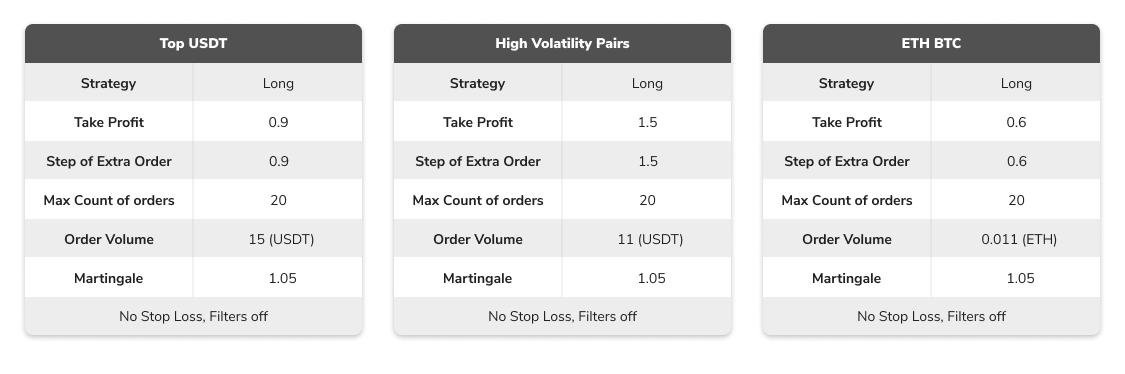

These are examples of my settings:

I think it’s easier to have control over DCA

MrCripto (manages the group for TradeSanta’s strategy discussion)

I use an old DCA crypto trading bot because of its simplicity. I’ve got a set of crypto trading strategies with Take Profit at levels from 0.3 to 1.5. I prefer to set up an order volume as a fixed value so that I know exactly what sum will be used. The number of extra orders can be set to 1, 3, 5 ,15, 25, 40, depending on the strategy used.

New DCA bots have MACD and RSI signals. Our PRO group has noticed that RSI filters work great for short strategies, especially they’re useful to cover the long-strategy bots.

I appreciate new DCA’s clear and detailed information about a bot’s position and probably will switch to it after it comes out of Beta.

“A lot of traders from the Pro Group use Grid bot. However, I believe that it’s more difficult to have control over a bot that has separate buy and sell orders instead of just one take-profit order as in the case with the DCA strategy. The provided analytics may be helpful to look at. If the trade goes south you can close the deal manually.”

In the trading group I moderate, we offer 5-6 different crypto trading strategies depending on the bot type and the trading sum. We’ve also created daily strategies that close the deals faster. Feel free to join the group and ask questions.

Here’s my personal strategy I call ONLYLONGUSDT. This strategy is applied to USDT pairs. As the base currency you should select a coin that you don’t mind having in your portfolio. The strategy is well covered with EOs.

Here is what my Long USDT Bot settings look like! Strategy: Long; TP: 0.4-0.8; SEO: 0.6 – 1; MaxCount: 25-30; Order Volume: 20-40USDT; Martingale: 1.0;

LAST WEEK’S TOP PERFORMING TRADING BOTS

BINANCE

| Pair | Settings | Deals closed | Profitability in % (Take Profit * Deals) | |

| DCA | ETHUSDT | Take Profit: 5% Extra Orders: 0 Step of Extra Orders: 0 Bollinger | 31 | 216% |

| HOTBNB | Take Profit: 9% Extra Orders: 3 Step of Extra Orders: 0.1 RSI | 24 | 155% | |

| BNBBTC | Take Profit: 6% Extra Orders: 20 Step of Extra Orders: 0.1 Bollinger | 25 | 150% | |

| Grid | ETHUSDT | Take Profit: 9% Extra Orders: 5 Step of Extra Orders: 2,5 | 31 | 320% |

| ETHUSDT | Take Profit: 6% Extra Orders: 5 Step of Extra Orders: 2 | 32 | 192% | |

| WAVESUSDT | Take Profit: 1% Extra Orders: 20 Step of Extra Orders: 1,5 | 192 | 192% |

HITBTC

| Strategy | Pair | Settings | Deals closed | Profitability in % (Take Profit * Deals) |

| DCA | DGBUSD | Take Profit: 6% Extra Orders: 4 Step of Extra Orders: 6 | 25 | 150% |

| LINKUSDT | Take Profit: 5% Extra Orders: 2 Step of Extra Orders: 5 | 19 | 95% | |

| TRXBTC | Take Profit: 1% Extra Orders: 1 Step of Extra Orders: 1 | 45 | 45% | |

| Grid | OMGBTC | Take Profit: 20% Extra Orders: 1 Step of Extra Orders: 1 | 26 | 520% |

| ALGOBNB | Take Profit: 2% Extra Orders: 4 Step of Extra Orders: 1 | 52 | 104% | |

| DOGEBTC | Take Profit: 4% Extra Orders: 1 Step of Extra Orders: 2 | 22 | 88% |

HUOBI

| Strategy | Pair | Settings | Deals closed | Profitability in % (Take Profit * Deals) |

| DCA | NEXOBTC | Take Profit: 5% Extra Orders: 10 Step of Extra Orders: 5 | 26 | 130% |

| BTCEURO | Take Profit: 4% Extra Orders: 3 Step of Extra Orders: 1.5 | 9 | 36% | |

| ETHUSDT | Take Profit: 1% Extra Orders: 1 Step of Extra Orders: 1 | 35 | 35% | |

| Grid | SKM-USDT | Take Profit: 1% Extra Orders: 35 Step of Extra Orders: 1 | 281 | 281% |

| WAVES-USDT | Take Profit :1% Extra Orders: 35 Step of Extra Orders: 1 | 233 | 233% | |

| IRIS-USDT | Take Profit: 1% Extra Orders: 35 Step of Extra Orders: 1 | 210 | 210% |

We hope that this article was helpful to you in getting on board of automated trading. We’re eager to hear about your strategies and results!

Let us know about your victories or ask fellow traders for advice in TradeSanta’s Telegram chat.

FAQ

Are there any perfect settings for your bot?

The one perfect configuration doesn’t exist. With each crypto trading strategy, many things must be taken into account, specific to each portfolio (amount, objective, time). The market is so volatile and a subject to manipulation and/or speculation.